BLOG

Holiday Marketing Statistics: 5 Takeaways from 2020

Published: Nov 12, 2021

Find out the key holiday marketing statistics from peak season 2020 and discover our top tips to beat the Q1 slump.

2020 was truly a year for change, especially when it came to the eCommerce sector.

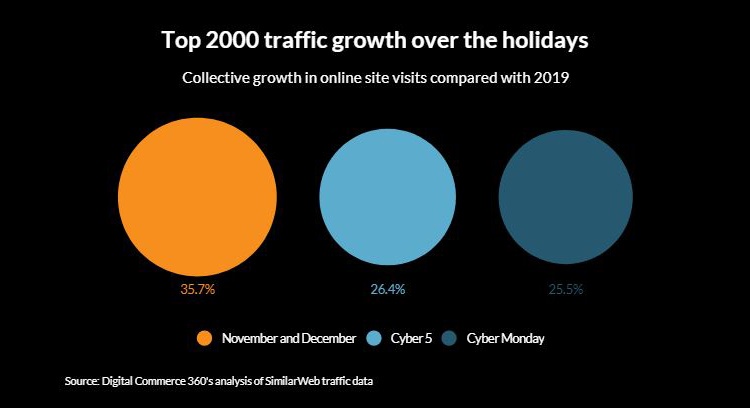

With COVID-19 acting as a strong catalyst for growth, retailers witnessed website traffic and consumer demand reach unparalleled levels. This was amid a monumental shift in shopping behavior as the world’s population became locked down at home in a bid to control the coronavirus.

With this in mind, we felt it fair to assume that peak season was likely to be one for the record books. So, in October Yieldify commissioned a research study, gathering opinions from 400 eCommerce leaders and 2000 consumers* to predict what might happen in the coming holiday season.

In this blog post, we’ll explore how those predictions matched up to reality. Starting with the top 5 holiday marketing statistics and takeaways:

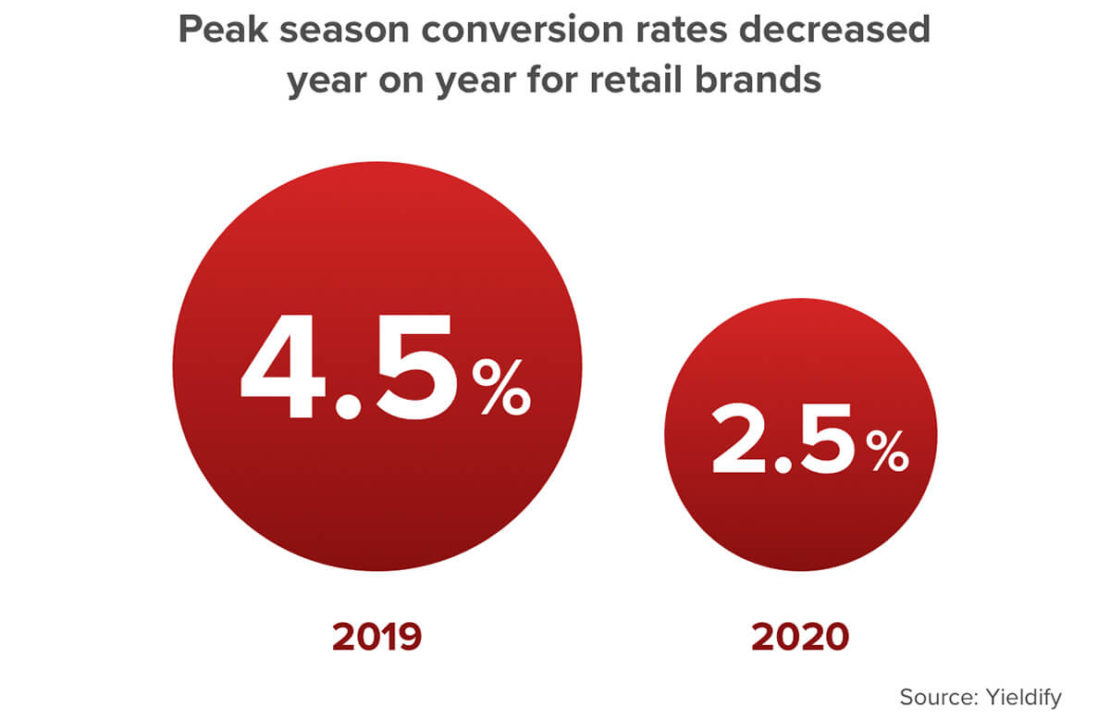

1. Despite an uptick in website traffic to eCommerce stores, conversions decreased by 2% year-on-year. Thus, underlining the crucial need to deploy conversion rate optimization tactics. (Data source: Yieldify)

2. Consumers continued new exploratory shopping habits. 58% of Cyber Weekend purchases were made by new visitors vs the 29% predicted, which presents a retention challenge to retailers post-holiday season. (Data source: Klaviyo)

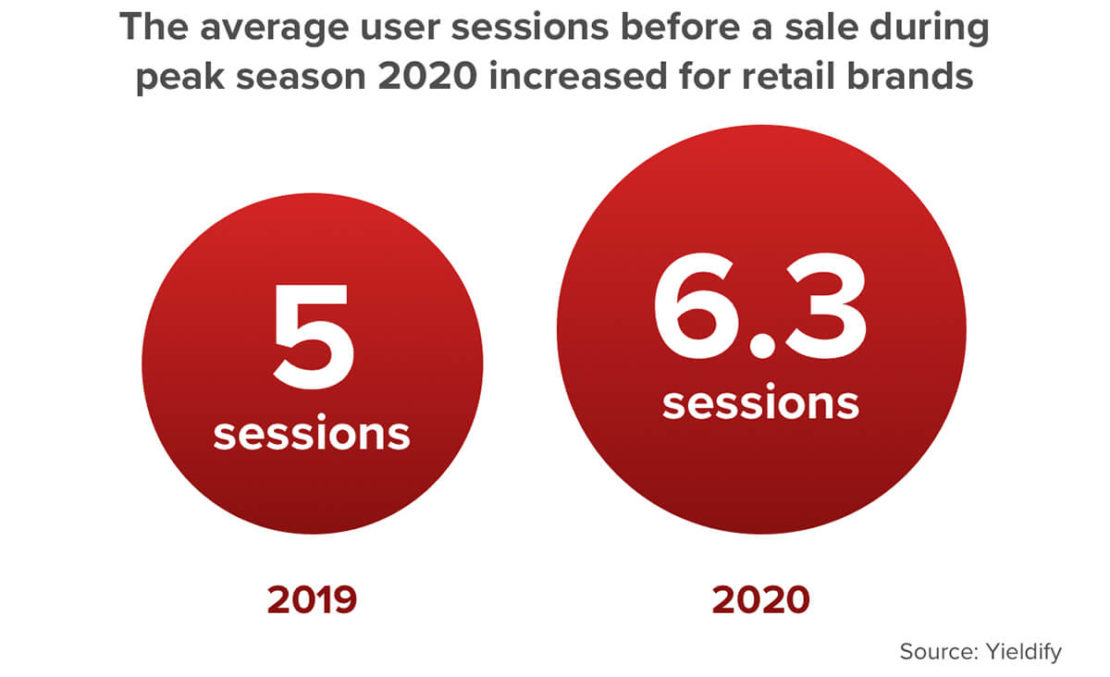

3. Higher consideration was given to online purchases this year, averaging 6.3 online sessions vs 5 in 2019. With more touchpoints to contend with, customer journey mapping will be more relevant than ever. (Data source: Yieldify)

4. Discounts declined in value and popularity in 2020 with 5% fewer emails featuring discount-related subject lines and 30-39% discounts yielding the most consumer interest. Proving that marginal sacrifice, while effective, is not critical to success. (Data source: Yieldify & Klaviyo)

5. Finally, email marketing proved a crucial channel for Cyber Weekend. Over 165 million emails were sent on Black Friday alone, which were directly responsible for 537,000 orders placed. This adds emphasis to having an effective lead capture strategy all year round. (Data source: Klaviyo)

A season of higher clicks but lower conversions

In line with all expectations, consumers hit eCommerce websites hard over the holiday season and sales skyrocketed.

So yes, opportunities were rife to significantly increase revenue. But this placed retailers under intense pressure to make outstanding first impressions with their new audience or risk abandonment.

Overall, eCommerce websites saw a 2% decrease in conversions, suggesting that not every onsite customer journey was up to the task.

The holiday marketing tactics that did work

While it’s true that overall conversions decreased, there were a whole host of tactics that eCommerce retailers deployed successfully.

In fact, the results for 2020 further highlighted the importance of having the right marketing tactics and conversion rate optimization strategy working together. It’s clear that success simply cannot be guaranteed from sheer acquisition alone.

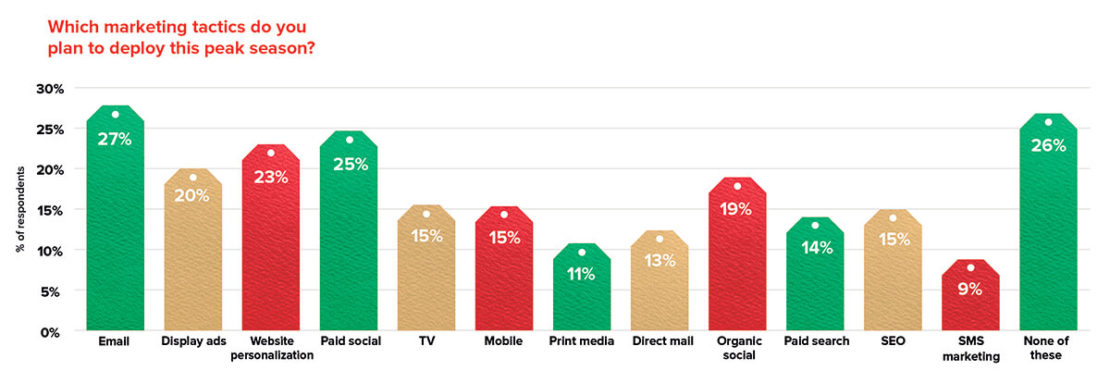

Back in October, our predictions showed that marketers placed high importance on email and website personalization to drive conversions. Now let’s take a deeper dive into how these tactics worked out for brands during the holiday season.

Email marketing

Over Cyber Weekend, email activity for eCommerce brands was off the charts. Record volumes of emails were sent to consumers and Black Friday proved the most popular. Klaviyo emails hit over 165 million inboxes in a single day.

And the result? Just short of 5 million orders were placed during October and November. All of which can be directly attributed to those emails sent.

Klaviyo’s client, Angel Jackets, echoed this sentiment. They saw great success from their ‘step into the New Year in Style’ email campaign.

“Email marketing worked out great for us. We use Klaviyo for email promotion. We sent a year-end email to our customers and mentioned – step into the New Year in Style. Not only the sales were good, but the click rate was also above expected.”

Syed Ali, Angel Jackets

Top tip for Q1: Make money while you sleep by using marketing automation for welcome emails, abandoned cart reminders, and more. Then, hone your approach through A/B testing, experimenting with different content, subject lines, or timing of emails in a series.

Website personalization

On the Yieldify side, we implemented a whole host of holiday eCommerce CRO strategies for our client base. These ranged from list building strategies, wishlist campaigns, social proof, gift guides, and checkout reminders.

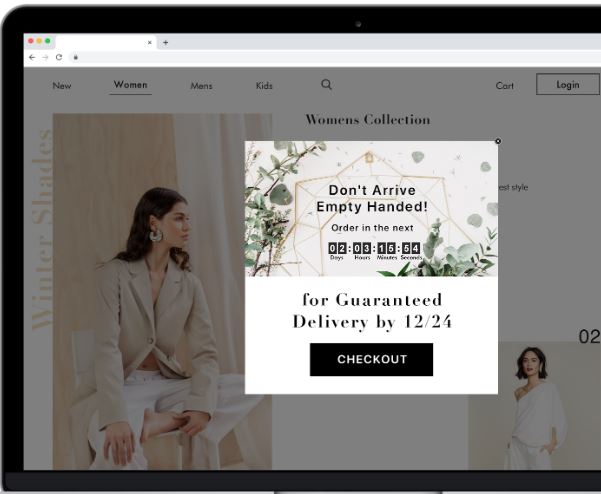

One particularly effective way we saw retailers driving urgency and in-session conversions was utilizing countdown timers.

This worked because many holiday visitors were shopping with a date in mind and were mindful of delivery delays as a result of COVID. This made counting down to delivery deadlines an incredibly effective tactic to nudge procrastinating gifters to convert.

By targeting users that had an item in their basket with a campaign visual such as the above, conversions increased by 8.5% on average.

Top tip for Q1: Effective conversion rate optimization (CRO) depends on segmenting and targeting accurately. Use behavioral segmentation to combine dozens of attributes to effectively launch messages that move your user towards conversion.

Getting more juice from the squeeze of each customer interaction

Simply put, the post-purchase experience is arguably just as important as the initial conversion. This is the key opportunity for brands to capitalize on that initial success, encourage repeat purchases, and drive higher customer lifetime value (CLV).

While 42% of Cyber Weekend purchases were made by repeat buyers, a huge 58% were made by first-time visitors. This presents a challenge post-holiday season of turning those visitors into long-term loyal customers who, according to Barilliance, are:

- 65.2% more likely to add an item to cart than a first-time visitor;

- 73.7% more likely to convert than first-time visitors;

- Projected to spend 16.2% more per transaction.

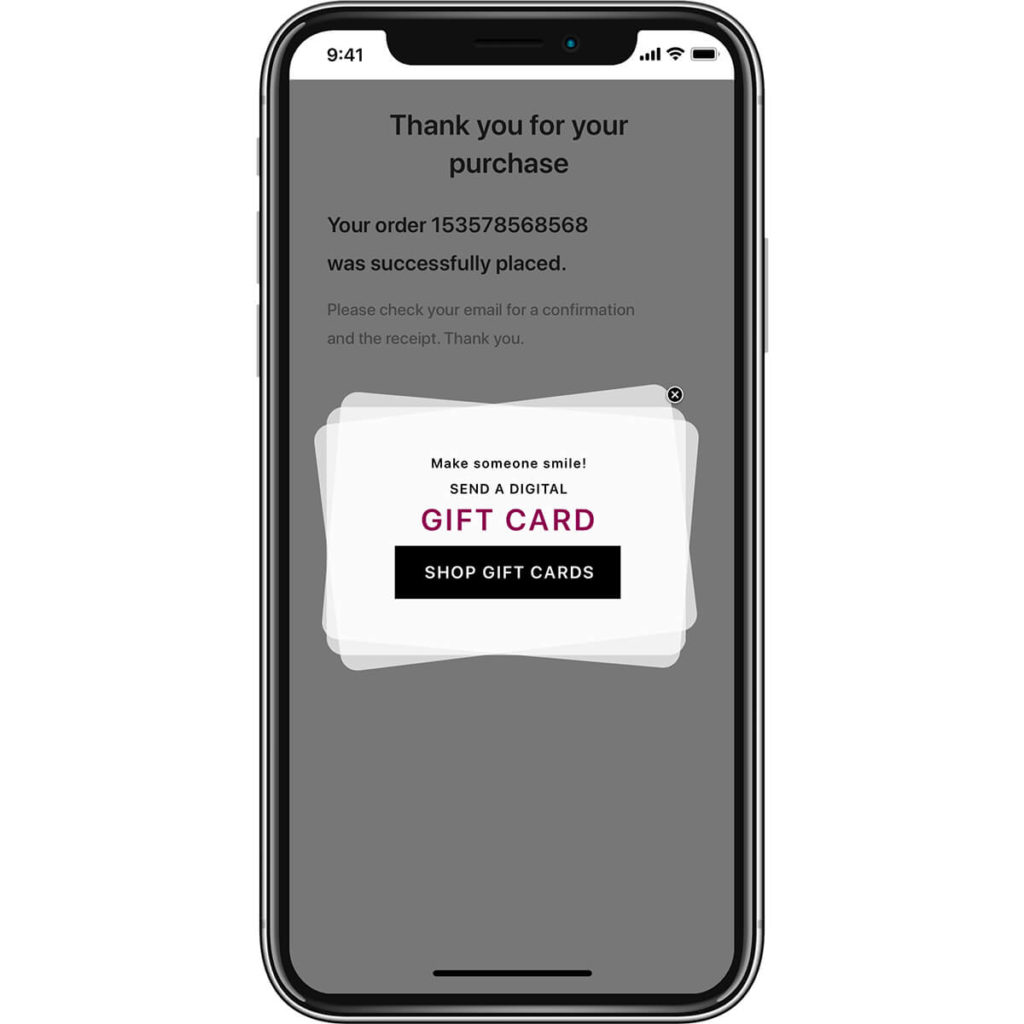

A tactic that we saw used successfully to do this was triggering campaign messaging on the confirmation screen as shown in the below example:

By targeting users at the very last point of the purchase journey, retailers could encourage repeat purchases while still in-session.

The ultimate goal here is to dissuade the customer from leaving your website for as long as possible by capturing their interest at the exact moment where you have the customer’s full attention.

On average, 4% of users converted a second time, while still in-session, when shown a variation of the above message.

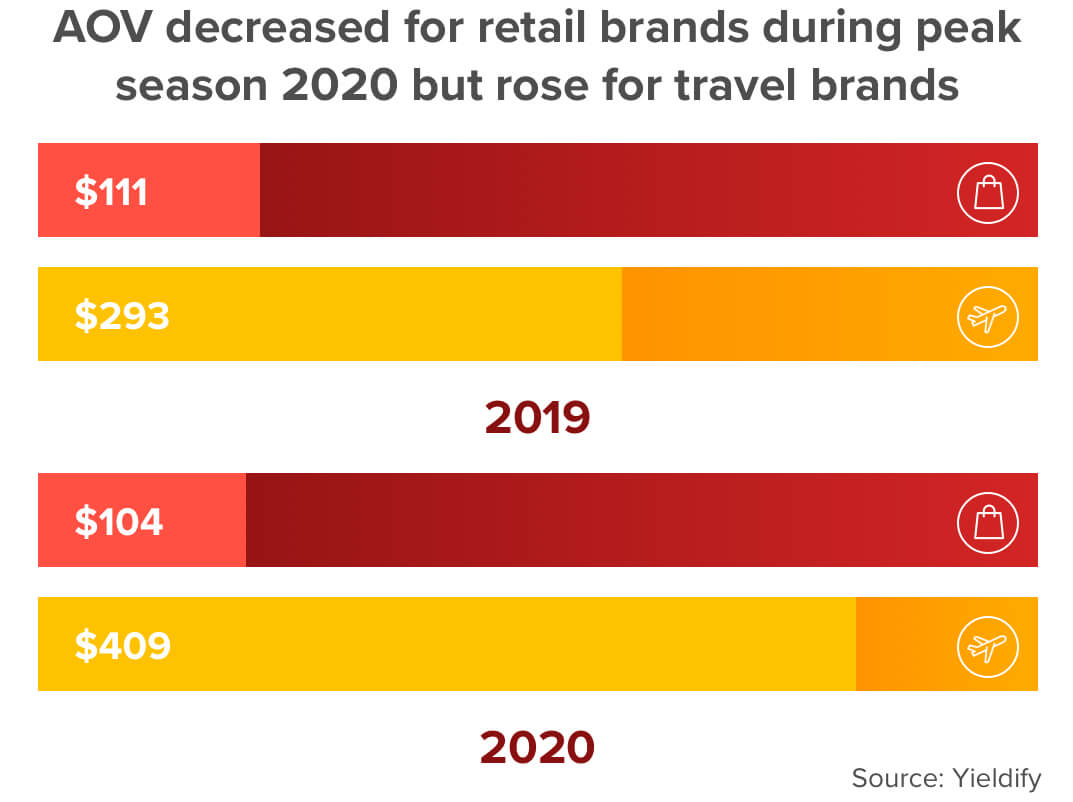

But what about AOV?

When you consider that the average order value for eCommerce retailers decreased by $7 across the holiday season 2020 – a boost of 16.2% from returning visitors sounds particularly enticing.

And increasing AOV for both new and returning users can be as simple as featuring a progress bar.

Progress bars are a great way to help shoppers track their acquired offers, and encourage them to continue spending more to get more.

Brands that deployed this tiered tactic not only increased AOV but also saw uplifts in conversions. Thus, making it a perfect tactic to bring through to Q1 strategies.

Top tip for Q1: Lifetime value might center around what a customer does on your website, but making sure that they return is half the challenge. Use email Remarketing to send smart, behaviorally-determined cart abandonment emails to ensure that you’re always front of mind.

Have we witnessed the death of the discount?

Following on from the tactics that worked, next, let’s look at the effectiveness of the messaging used – specifically discounts.

In our peak season analysis, we predicted that approximately 30% fewer brands would be offering discounts.

And for those that did, the discount amount was projected to be less than in previous years. The most popular discount levels for 2020 came in at 11-20% and 21-30% off.

These assumptions were supported by a post-holiday analysis of the email subject lines sent through Klaviyo during peak season.

While discount messaging was still popular, 5% fewer discount-orientated emails were sent. Also, across October and November, the percentage of non-discount focused subject lines came in at 69.8% and 63.8% respectively.

But did this Scrooge-like take on discounts pay off?

According to our latest data insights, yes!

Looking at the average click-through rate and average incremental click sales uplift, it is clear that offering 30-39% was the sweet spot to hit. This was far less than the stereotypical 70-80% off headlines seen in previous years. In fact, interest steeply fell when retailers offered 40% off or more.

As we move into Q1, more and more brands are starting to move away from margin giveaways, and with consumer demand remaining strong for eCommerce it’s hardly a surprise.

But what other incentives can retailers use?

Ultimately the answer to this will vary from brand to brand and the challenge is to experiment until you find the one that works best for your audience.

In the below example of our client, female fashion retailer Petal & Pup, incentivize visitors to share their email address in exchange for email alerts of new arrivals.

With 100’s of new styles being added to the website every week and the nature of fast fashion, where items sell-out exceptionally quickly, this messaging is spot on for their audience.

In just three months, Petal & Pup achieved a 116% increase in leads captured per week. Thus, supercharging new customer acquisition to fuel future email engagement.

Another solution for avoiding margin sacrifice unless absolutely necessary is switching up the exact time at which discounts are being presented. For example, try running tests across different points of the customer journey such as upon exit intent or upon a certain number of sessions instead of upon entry. The results might just surprise you!

Top tip for Q1: Many eCommerce retailers deploy thresholds on their sites, encouraging users to spend a little more to unlock discounts or perks such as free delivery. The problem is that many users never see them. Use content personalization to bring these messages front-and-center at the ideal moment.

In conclusion

After reviewing our selection of holiday marketing statistics, the tried and tested solution to overcoming the Q1 slump is simple: Effective customer journey optimization that combines both website personalization and email marketing together with one clear goal – revenue.

With visitors spending more sessions on-site before converting, the number of touchpoints has risen. To succeed, you need to optimize these touchpoints to encourage conversions, shorten the purchase cycle, and secure the all-important next sale. Ideally, without the need for a discount.

As the world continues to change throughout 2021, one thing is certain and that is that further change is coming for eCommerce retailers. Ultimately, it will be the retailers that can react to evolving consumer trends the fastest, with proven marketing strategies such as those we referenced, that will see the best results.

Happy 2021 everyone!

* 3 online surveys were conducted with a panel of potential respondents. The recruitment periods were 8th July 2019 to 31st July 2019 and 31st July 2020 to 21st August 2020. A total of 400 respondents completed the first two surveys. 200 respondents residing in the UK and 200 respondents residing in the US. Only senior marketers or eCommerce directors at retailers with an eCommerce presence were eligible to take part and complete the survey. A total of 2000 respondents completed the third survey. 1000 respondents residing in the UK and 200 respondents residing in the US. All questions within the survey were verified to be MRS compliant by a marketing research company specializing in online and mobile polling.